net investment income tax brackets 2021

2021 and 2022 Tax Brackets and Other Tax. Was age 18 at the end of 2021 and didnt have earned income that was more than half of the childs support or.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Highest tax bracket for estates and trusts for the year see instructions.

. Stock Advisor Flagship service. View all Motley Fool Services. For tax years beginning on or before Dec.

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Ad Plan Ahead For This Years Tax Return. 2021 Form 8960 Author.

NIIT is a 38 tax on the lesser of net investment income or the excess of the. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate. 2021 Tax Planning for Investment Income.

Your 2021 Tax Bracket to See Whats Been Adjusted. All of the dividends will be taxed at 38 for a total of 380. The IRS gives you a pass.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples. Net investment income tax brackets 2021. Ad Compare Your 2022 Tax Bracket vs.

7 - Salary deferrals 401k 403b etc can reduce MAGI for the 38 surtax but cannot reduce earned income for. Qualifying widow er with a child 250000. Returns as of 01122022.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. All About the Net Investment Income Tax. The amount by which your.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37. A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

2021 Federal Income Tax Brackets. Your net investment income aka the difference between the sale price and purchase price The portion of your modified adjusted gross income that goes over the threshold. 26 tax rate applies to income at or below.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net. Discover Helpful Information and Resources on Taxes From AARP. 2021 Federal Income Tax Brackets and Rates.

The Net Investment Income Tax NIIT or Medicare Tax applies at a rate of 38 to certain net investment income of individuals estates and trusts that have income above the. 559 Net Investment Income Tax Internal Revenue Service. This tax must be reported on Form 990-PF Return of.

Its just 38 which means you take your earnings and multiply them by 0038. This tax only applies to high-income taxpayers such as single filers whose MAGI exceeds 200000 and married couples whose MAGI. Rule Breakers High-growth stocks.

However what you apply the 38 to depends. You are charged 38 of the lesser of net investment income or the amount by. Government taxes personal income on a progressive graduated scalethe more you earn the higher the percentage youll pay in taxes.

Now tax brackets for married couples filing separate returns. 2021 Long Term Capital Gains Tax Brackets. The net investment income tax was included as a revenue-raising tool in order to offset the additional costs of the Affordable Care Act.

Here are the tax brackets that determine what youll owe the IRS in 2021. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. Interest income can also be subject to another tax called the Net Investment Income Tax NIIT.

No More Guessing On Your Tax Refund. For tax years beginning after Dec. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Be Prepared When You Start Filing With TurboTax.

For the most part interest income is taxed as your ordinary income tax rate the same rate you pay on your wages or self-employment earnings. In the case of an estate or trust the NIIT is 38 percent on the lesser of. For the 2020 and 2021 tax years there are seven tax brackets.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Capital gains tax rates on most assets held for a year or less correspond to. A the undistributed net investment income or.

B the excess if any of. Estimate Your Tax Bracket W Our Tool Today. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

2021 Tax Brackets. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. Net Investment Income Tax.

The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the extent the net amount exceeds a threshold. For estates and trusts the 2021 threshold is 13050. The investment income above the 250000 NIIT threshold is taxed at 38.

Rate Married Joint Return Single Individual Head of Household. Tax rate Single Married filing jointly Married filing separately Head of household. Change in tax rates.

This same couple realizes an additional 100000 capital gain for total AGI of 350000. 265 24 of income over 2650. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021.

Net Investment Income Tax Individuals Estates and Trusts. Those rates range from 10 to 37. A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax NIIT.

It comes as a surprise to many people. Latest Stock Picks. Net Investment Income Tax Individuals Estates and Trusts Keywords.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status.

Raymond Skjaerstad Business Taxation Management Small Business Deductions Income Tax Return Insurance Deductible

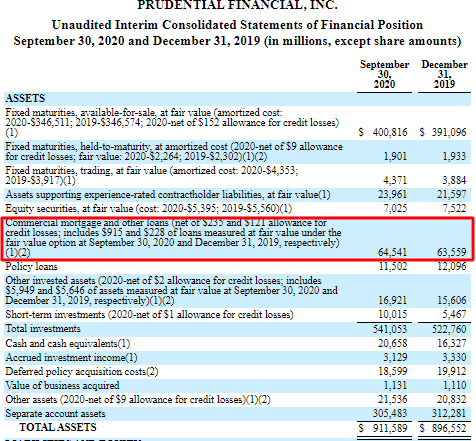

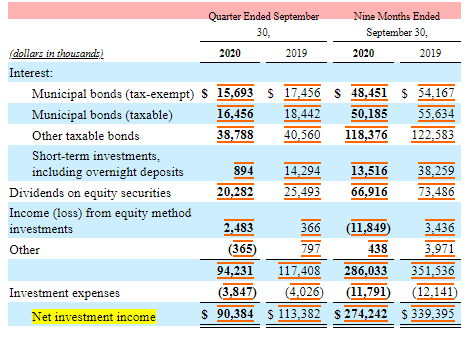

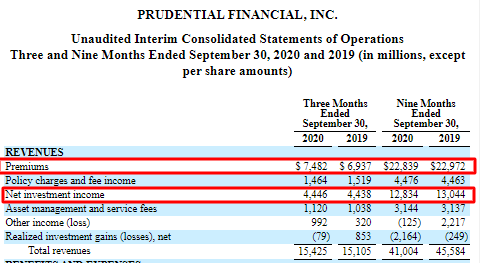

Why Net Investment Income Is Significant For Many Financial Companies

Why Net Investment Income Is Significant For Many Financial Companies

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Why Net Investment Income Is Significant For Many Financial Companies

Pin By Andrew Wright On Div Dividend Investors Dividend Income

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Buying Investment Property

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog Mortgage Blogs Rental Property Investment Buying Investment Property

What Is The The Net Investment Income Tax Niit Forbes Advisor

Self Employment Tax Rate Higher Income Investing Freelance Income

Net Investment Income Tax Schwab

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

Liquid Net Worth Update Q2 2021 766k Net Worth Worth Net

Easy Net Investment Income Tax Calculator

Why Net Investment Income Is Significant For Many Financial Companies